About conference

A one-day professional conference focused on current topics in the field of business valuation, organized by the Faculty of Finance and Accounting at the Prague University of Economics and Business (VŠE). The conference is primarily intended for valuation experts, consultants and financing providers, as well as for alumni and Corporate Finance students. The primary goal of the conference is to connect the business with academia and policy makers. The long-term goal is to improve the quality of Corporate Finance education at VŠE.

This year’s conference will be graced by distinguished board members of the International Valuation Standards Council (IVSC). The IVSC is responsible for developing the International Valuation Standards (IVS), which are used in over 100 countries to support consistency, comparability and transparency to valuations of all assets and liabilities. The Prague University of Economics and Business is the only academic member of the International Valuation Standards Council from the Czech Republic.

Themes for the 2025: IVSC at the Prague University of Economics and Business

- News in IVS and Future Topics

- Implementation of IVS in the Czech Republic

- Harmonization of IVS, RICS and IFRS

| Date: | 12.6. 2025 9:00 a.m. – 6:00 p.m. |

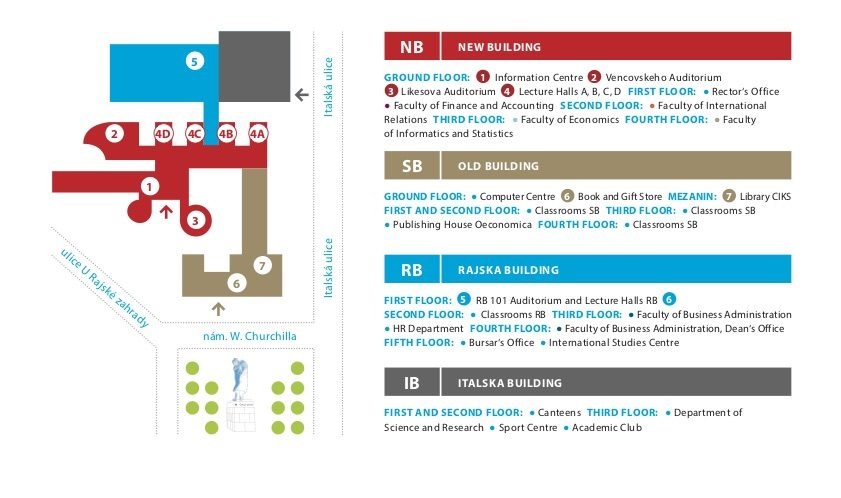

| Location: | RB 101 VŠE Žižkov, Prague |

| Form: | Present |

| Language: | English (The conference will be interpreted into Czech.) |

| For: | Valuation experts, consultants, financing providers business valuation, real estate, tangible assets, financial instruments |

| Price | 4.300,- CZK + VAT (total 5.203 CZK) |